コレクション irs form 9325 407712-How to get form 9325

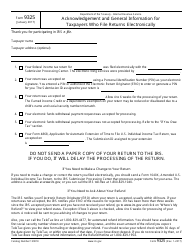

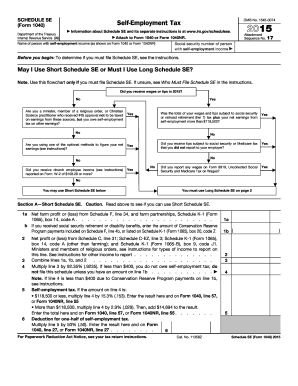

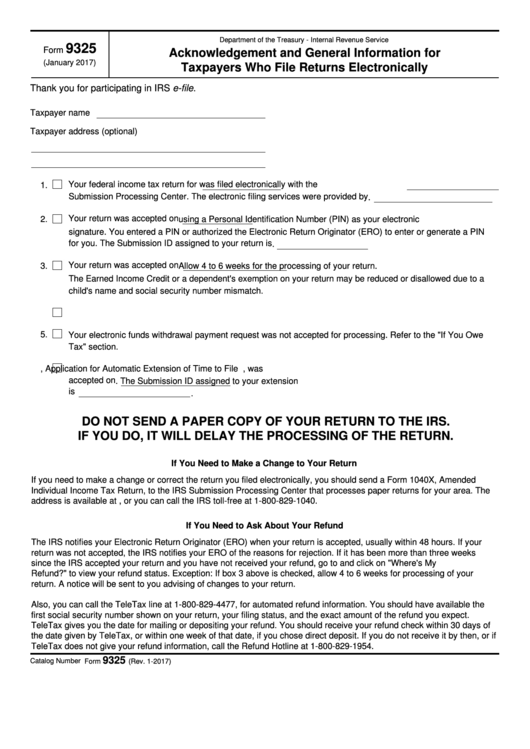

Form 8453 returns shown as PIN returns on Form 9325 You do not need to mail Forms 8453 for these returns This discrepancy occurs when you enter AGI information in the PIN area on the Main Info sheet but you do not enter other PIN information Form 9325 sees the AGI information on the Main Info form and mistakenly identifies the return as aMar 07, 21 · ProSeries Basic 1154 AM Usually once a return is accepted, when I open the return again the 9325 pops up in the list of forms in use 0953 AM Yes it did in prior years but not nowSep 06, · And, I do have a blank Form 9325 at the ready in case his lender asks for it, but we don't expect a boxticker to ask for it as it's not listed by name on his list of boxes The lender's still asking for an IRS transcript So, we created a package

Ce 8 X Gps Tax Supplies

How to get form 9325

How to get form 9325-Below are the most popular support articles associated with Form 9325 Printing Form 9325 as an Electronic Filing ReceiptApr 12, · The IRS says 9 out of 10 filers who efile and choose direct deposit will get their Federal refunds within 21 days after the efiled return was accepted for processing Some returns are processed fairly quickly, while others require additional processing due to specific items in the return The amount to use is on your Federal Form 1040, Line

Form I 864 Affidavit Of Support Help Center Chodorow Law Offices

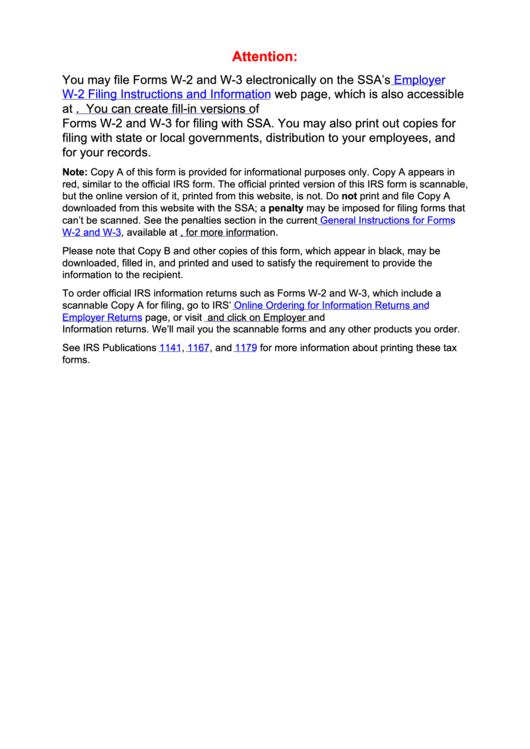

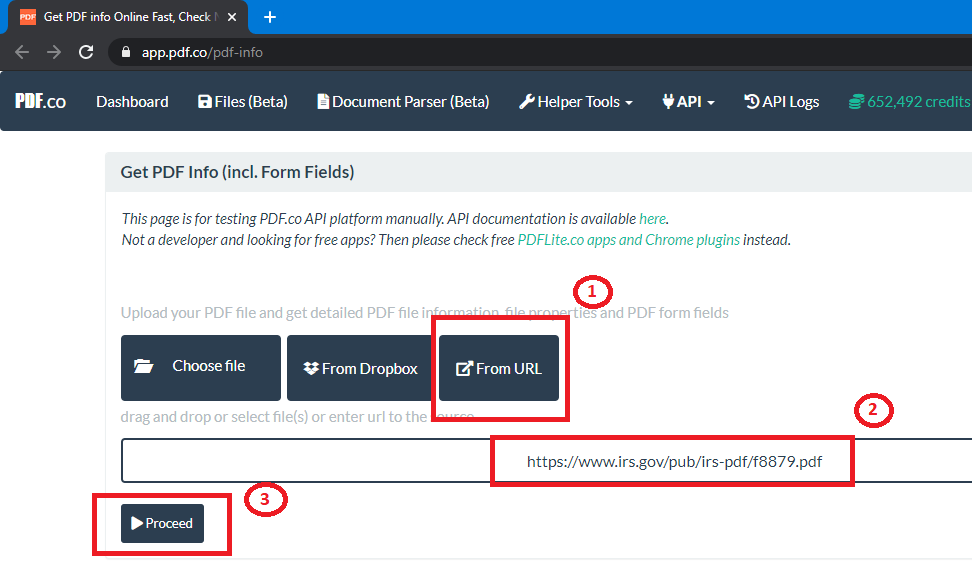

The preparation of legal documents can be highpriced and timeconsuming However, with our preconfigured online templates, things get simpler Now, using a Irs Form 9325 takes no more than 5 minutes Our statespecific webbased blanks and complete recommendations eradicate humanprone mistakesClick this option to print IRS Form 9325, Acknowledgement and General Information for Taxpayers who File Returns Electronically or the state Form 9325 facsimile for the client(s) you selected in the status list ELF History ReportData, put and ask for legallybinding electronic signatures Get the job done from any gadget and share docs by email or fax

SignNow combines ease of use, affordability and security in one online tool, all without forcing extra software on you All you need is smooth internet connection and a device to work on Follow the stepbystep instructions below to esign your form 9325 19Form 9325 Acknowledgement and General Information for Taxpayers Who File Returns Electronically (14) free download and preview, download free printable template samples in PDF, Word and Excel formatsForm 9325 Make the most of a digital solution to generate, edit and sign documents in PDF or Word format online Convert them into templates for numerous use, insert fillable fields to collect recipients?

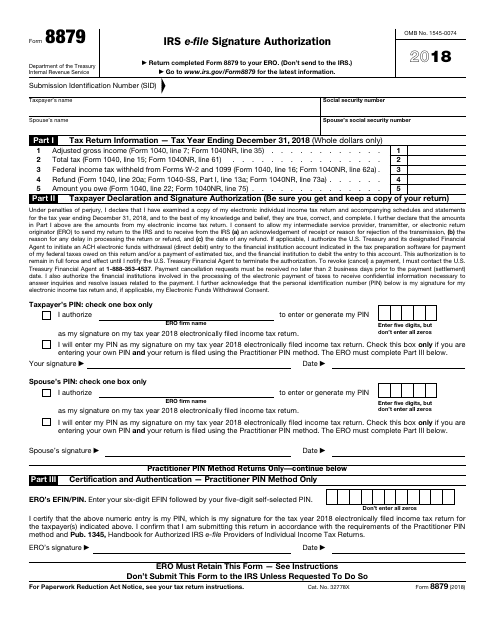

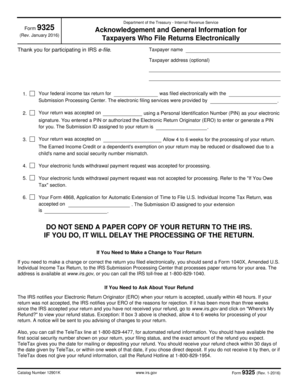

Form 9325 is a confirmation form from the IRS that the tax return or extension has been received through the electronic filing process and accepted by the IRS This form is not required, but some taxpayers may request this form to prove their returns have been efiled and accepted by the IRSIrs form 9325for a onesizefitsall solution to esign form 9325?Internal Revenue Service Form 9325 (Rev January 12) Catalog Number K 9325 (Rev 112) The IRS uses refunds to cover overdue taxes and notifies you when this occurs The Financial Management Service (FMS) offsets refunds through the Treasury Offset Program (TOP) to cover past due child support, federal agency nontax

Www Calt Iastate Edu System Files Premium Video Files The scoop april 16 2 per slide Pdf

E Filing Your Tax Returns Tax Pro Plus

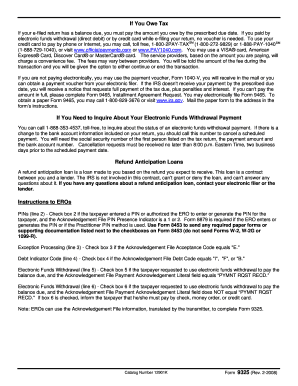

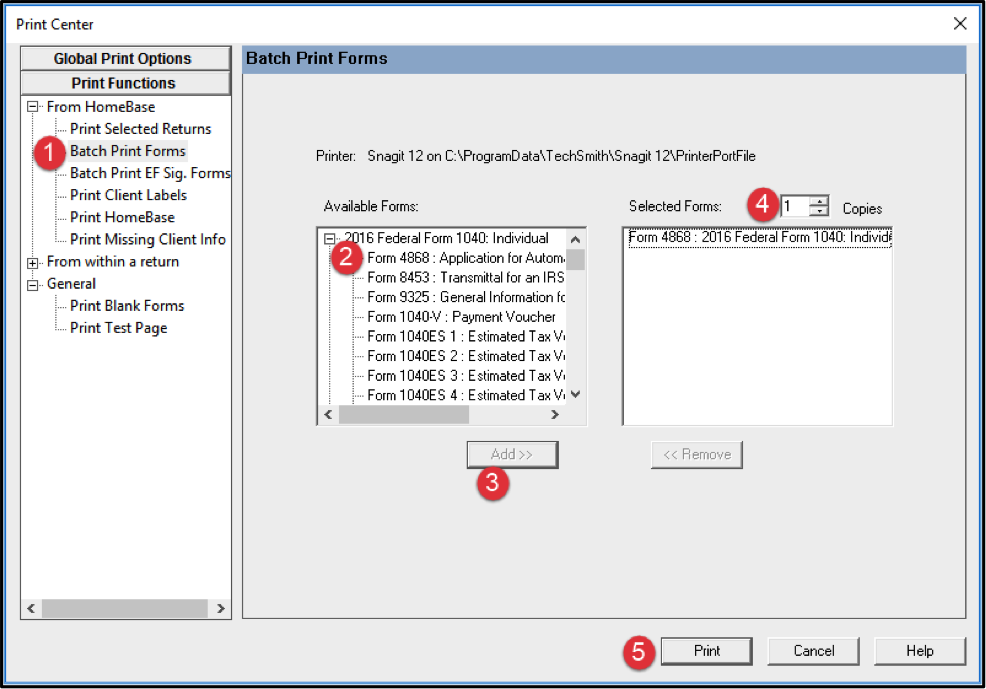

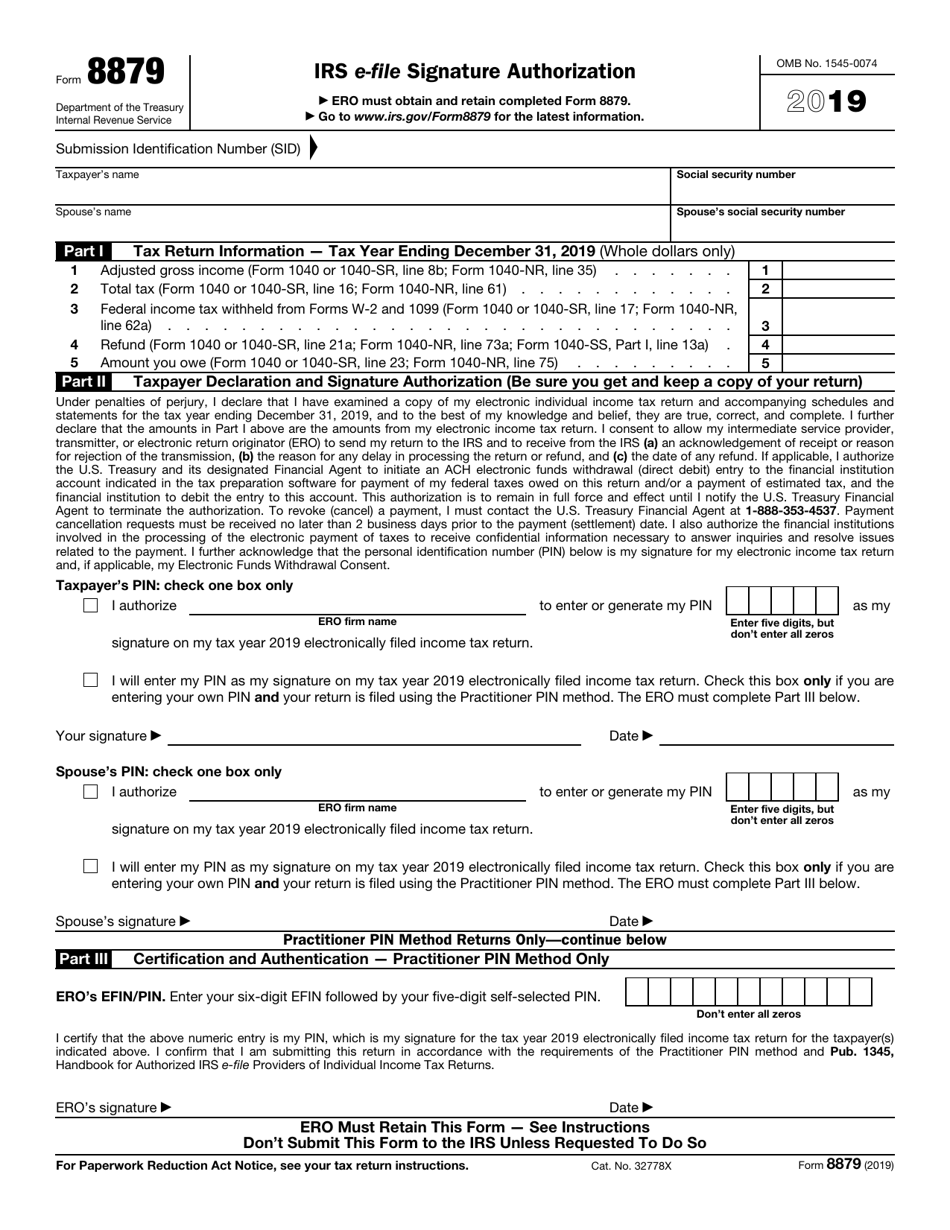

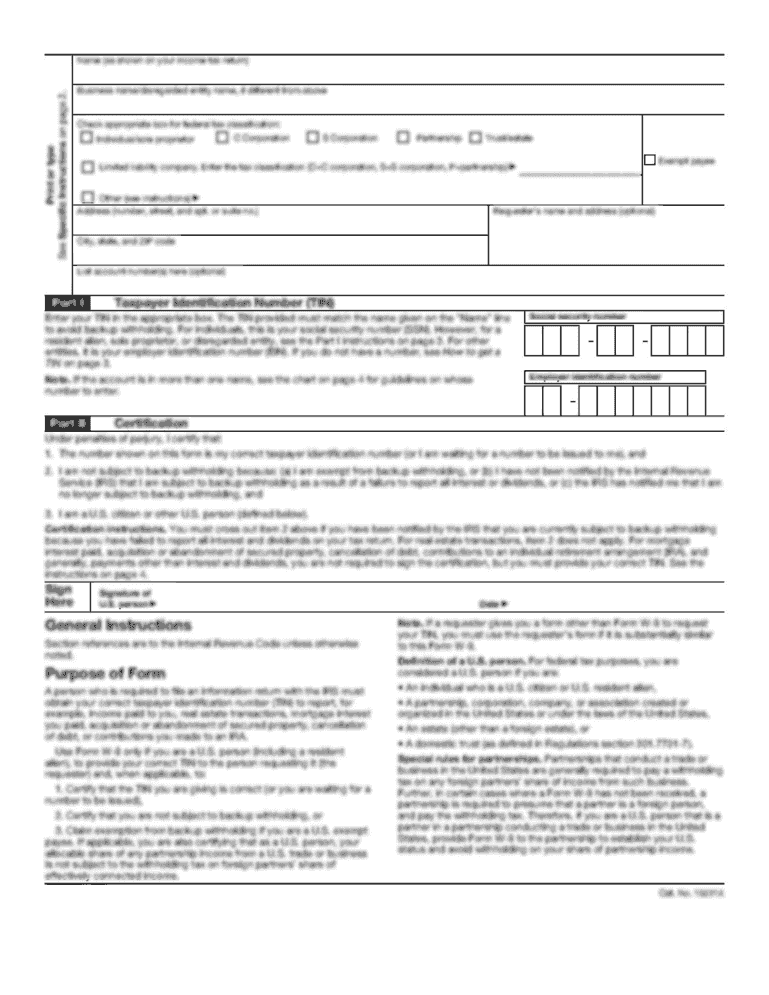

Number (SID) assigned to the tax return, or associate Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically, with Form 79 after filing If Form 9325 is used to provide the SID, it isn't required to be physically attached to Form 79 However, it must be kept in accordanceForm 9325 (Rev January 01) Thank you for taking part in the IRS efile Program Your federal income tax return for is being filed electronically with the Service Center of the IRS by the services of Your return was accepted by IRS on and the Declaration Control Number (DCN) assigned toTo create a batch of electronic file acknowledgments (Form 9325), complete these steps Choose Utilities > Electronic Filing Status to open the Electronic Filing Status dialog Click the filter icon for the Status column Select one of the following items from the dropdown list

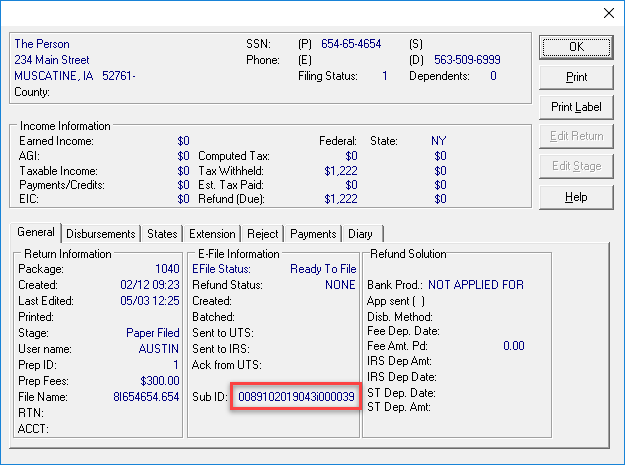

What Is A Submission Id Ultimatetax Solution Center

Ecfsapi Fcc Gov File Pdf

How can I get Form 9325 to them?Fill Online, Printable, Fillable, Blank Form 9325 Acknowledgement and General Information for Taxpayers Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadableForm 31A ACH Vendor/Miscellaneous Payment Enrollment HCTC 0517 Form 9325 Acknowledgement and General Information for Taxpayers Who File Returns Electronically 0117 Form 1099A Acquisition or Abandonment

Www Efile Com Tax Form 19 Federal Form 79 Irs E File Signature Authorization Pdf

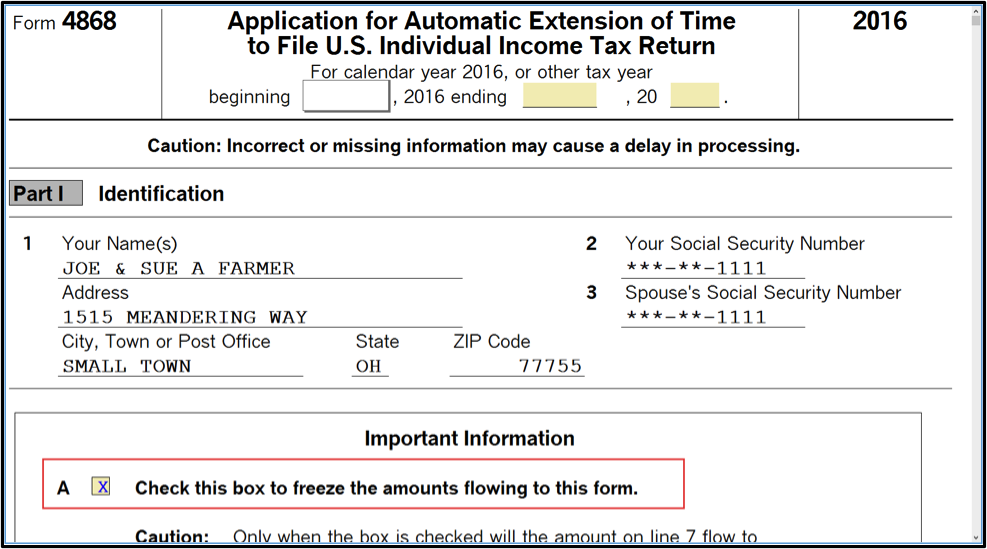

Proseries Extensions And How To Report Them Tax Pro Center Intuit

This notice will show your tax due, plus any interest and penalty assessments for late payment We appreciate your taking advantage of MDOR Electronic Filing We are continuing to look for new methods and technologies to make filing your tax returns simple and easy Electronic Filing Program PO Box 7013, Boston, MA 024 Form M9325 ElectronicOf course there is a E file verification history form Just doesn't look as formal when sending to client or client lending requestDec 07, 19 · The efile acknowledgement shows that the TP's tax return was accepted by the IRS but the IRS says no tax return was filed 1719 1051 AM TP received a notice from the IRS that her 18 tax return was not filed yet Her efile acknowledgement shows that the IRS accepted her return on 7/11/19 This is a first for me

Filing Returns Electronically

Fill Free Fillable Form 9325 Acknowledgement And General Information For Taxpayers Pdf Form

I'm self employed, applying for a loan, and the lender is looking to verify that my 15 & 16 tax returns are a filed copyCreate a blank & editable 9325 form, fill it out and send it instantly to the IRS Download & print with other fillable US tax forms in PDF No paper No software installation Any device and OS Try it Now!How can I get Form 9325 to them?

Form 9325 Acknowledgement And General Information For Taxpayers Who File Returns Electronically 14 Free Download

Ce 8 X Gps Tax Supplies

Form 9325 Acknowledgement and General Information for (January 17)Taxpayers Who File Returns Electronically Thank you for participating in IRS efileFollow these tips to correctly and quickly fill out IRS 9325 The way to submit the IRS 9325 online Select the button Get Form to open it and begin modifying Fill out all required lines in the selected file utilizing our advantageous PDF editorIn accordance with the IRS form design, the taxpayer's address is rightjustified when the facsimile of Form 9325 is printed To have the taxpayer's address print leftjustified on the facsimile of Form 9325, mark the Print Form 9325 taxpayer mailing address leftjustified checkbox in the Other group box in the Return Presentation tab

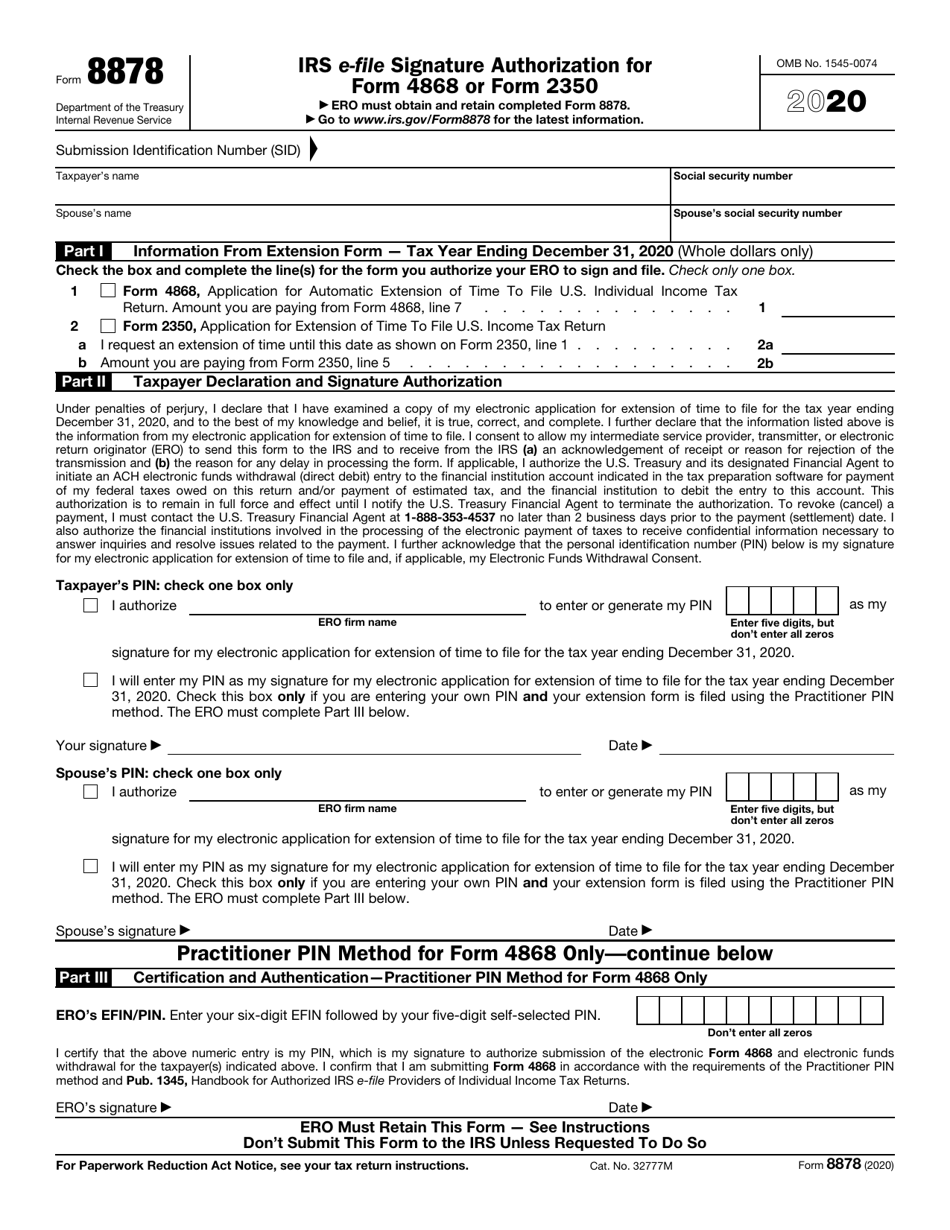

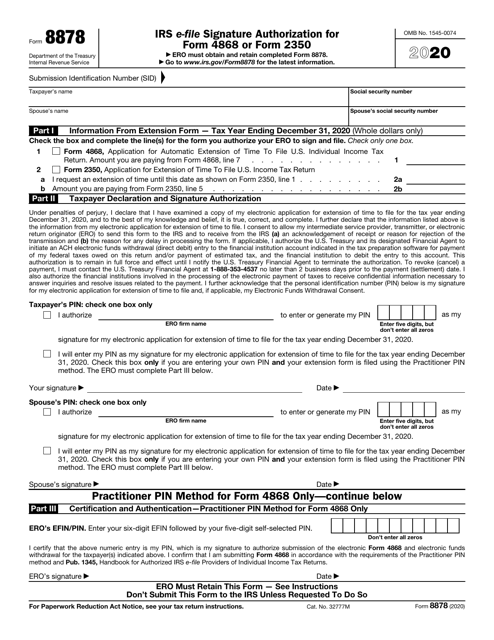

Irs Form 78 Download Fillable Pdf Or Fill Online Irs E File Signature Authorization For Form 4868 Or Form 2350 Templateroller

Form 9325 After Irs Acceptance Notifying The Taxpayer

Form 9325, Acknowledgment and General Information for Taxpayers who File Returns Electronically, appears only in 1040 returns Beginning with Drake15, business returns (1041, 1065, 11, and 11S packages) generate an EF Notice, or a state EF Notice, page in view that serves as an acknowledgement that the return has been transmitted through the software and received by the IRSYou have two options in an individual return you can print and deliver Form 9325 yourself, or you can have Drake automatically email it to the taxpayer In either case, blocks 1 and 2 on Form 9325 are completed only after the return has been acceptedJun 08, 19 · How can I find a tax filing receipt received from a tax preparer OR An electronic postmark generated by a tax preparer or tax return software OR A completed Form 9325?

Irs Form 79 Download Fillable Pdf Or Fill Online Irs E File Signature Authorization Templateroller

Form 79 Irs E File Signature Authorization 14 Free Download

You have two options in an individual return you can print and deliver Form 9325 yourself, or you can have Drake automatically email it to the taxpayer In either case, blocks 1 and 2 on Form 9325 are completed only after the return has been acceptedEasily complete a printable IRS 9325 Form 17 online Get ready for this year's Tax Season quickly and safely with pdfFiller!Dec 10, 17 · Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund 10 Form 941X (PR) Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund (Puerto Rico Version) 10 Form 1118 (Schedule J) Adjustments to Separate Limitation Income (Loss) Categories for Determining Numerators of Limitation Fractions

Www Unclefed Com Irs Forms 00 F9325 Pdf

Irs Form 78 Download Fillable Pdf Or Fill Online Irs E File Signature Authorization For Form 4868 Or Form 2350 Templateroller

Jan 31, · ProSeries inserts the Form 9325 into the client file with the acknowledgement information, does ProConnect insert the 9325 also?Dec 07, 19 · 1719 0614 AM Once I receive the 9325 back, I have always assumed everything went through as directed After a panicked nth hour text from a client tonight, I went back and checked and quite a few of my 9325 say the electronic withdrawal was rejected when in fact it when throughDepartment of the Treasury Internal Revenue Service Form 9325 Acknowledgement and General Information for (Rev January 00) Taxpayers Who File Returns Electronically Thank you for taking part in the IRS efile Program Your federal income tax return for tax year is being filed electronically with the Service Center of the IRS by the services of

Http Vanblakesinc Com Userfiles File F79 Accessible Pdf

Fillable Online Form 9325 Rev October 03 Fill In Version Fax Email Print Pdffiller

Title FORM 9325 (REV ) Subject GENERAL INFORMATION FOR TAXPAYERS WHO FILE RETURNS ELECTRONICALLY Created Date 6/2/1999 PMForm Application for Withdrawal of Filed Form 668 (Y), Notice of Federal Tax Lien (Internal Revenue Code Section 6323 (j)) 1011 Form Summary Notice of Determination, Waiver of Right to Judicial Review of a Collection Due Process Determination, Waiver of Suspension of Levy Action, and Waiver of Periods of Limitation inForm 9325 (Rev 117) The IRS uses refunds to cover overdue taxes and notifies you when this occurs

Ecfsapi Fcc Gov File Pdf

1040 Internal Revenue Service

9325 (Rev 116) Form 9325 (Rev January 16) Department of the Treasury Internal Revenue Service Acknowledgement and General Information for Taxpayers Who File Returns Electronically Thank you for participating in IRS efile Taxpayer name Taxpayer address (optional) 1 Your federal income tax return for was filed electronicallyForms and Publications (PDF) Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information onForm 9325 instructions Make use of a digital solution to generate, edit and sign documents in PDF or Word format on the web Turn them into templates for multiple use, incorporate fillable fields to collect recipients?

Irs Form 9325 Download Fillable Pdf Or Fill Online Acknowledgement And General Information For Taxpayers Who File Returns Electronically Templateroller

Form 9325 Fill Online Printable Fillable Blank Pdffiller

Data, put and ask for legallybinding digital signatures Get the job done from any device and share docs by email or fax Try out now?♪♫•*¨*•¸¸ ♥Lisa♥ ¸¸•*¨*•♫♪ 0 CheersTitle FORM 9325 (REV ) Subject GENERAL INFORMATION FOR TAXPAYERS WHO FILE RETURNS ELECTRONICALLY Created Date 4/14/1999 PM

How To Know Your Electronically Filed Income Tax Return Was Really Filed

Submission Id Sid

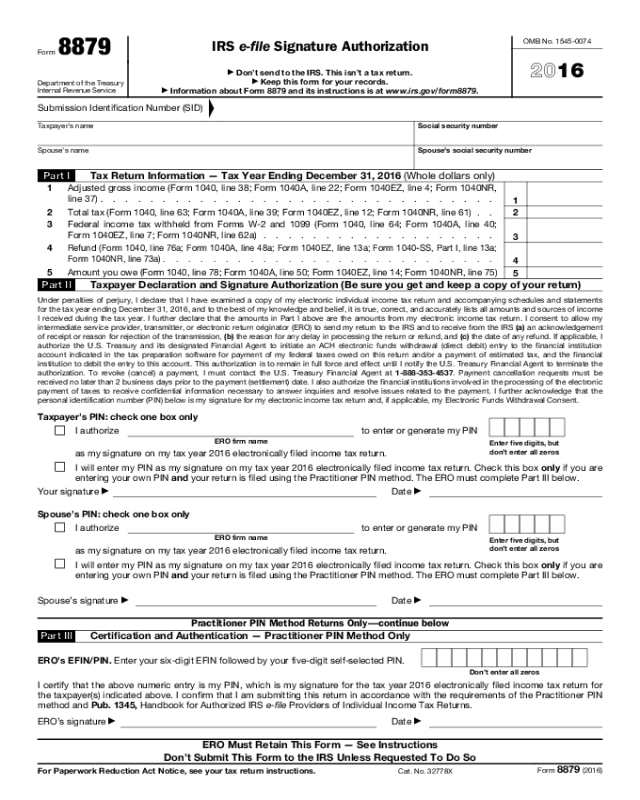

Dec 07, 19 · Is there a similar Form to 9325 for Business Tax Returns?Email 9325 Notice to Taxpayer (automatic from Drake Processing Center) This option enables Drake to email a completed Form 9325 to the taxpayer when a 1040 return is accepted, but only if the option is checked before the return is efiled the taxpayer's valid email address is entered accurately on screen 1Instructions for Form 78, Partner's Additional Reporting Year Tax 1219 10/31/ Form 78 (Schedule A) Partner's Additional Reporting Year Tax (Schedule of Adjustments) 1219 01/30/ Form 79 Partnership Representative Revocation/Designation and Resignation Form

1040 Internal Revenue Service

Ecfsapi Fcc Gov File Pdf

TD 9325, Distributions from a Pension Plan upon Attainment of Normal Retirement Age, 05/21/07 Advance Notices of Proposed Rulemaking & Treasury Decisions TD 9325 Distributions from a Pension Plan upon Attainment of Normal Retirement Age AGENCY Internal Revenue Service (IRS), Treasury ACTION Final regulationsCatalog Number K Form 9325(Rev 114) Form 9325 (Rev January 14) Acknowledgement and General Information for Taxpayers Who File Returns Electronically Department of the Treasury Internal Revenue Service Thank you for participating in IRS efile Taxpayer name Taxpayer address (optional) 1Dec 19, 13 · Form 9325 is a confirmation form from the IRS that their tax return has been received through the electronic filing process This form is not required, but some taxpayers may request to have this

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Eformrs Com Forms09 Fedpdf09 9325 Pdf

Form 9325 is a confirmation form from the IRS that the tax return or extension has been received through the electronic filing process and accepted by the IRS This form is not required, but some taxpayers may request this form to prove their returns have been efiled and accepted by the IRSIRS Form 9325 is a disclosure printed by your tax preparer It is NOT included in your tax return that is filed with the IRS The ONLY place you will be able to get this specific document is from your preparer If you had your tax return done at H&RB, that isYes, however, the SID is not available before a return is accepted Beginning in Drake15, t he full SID is displayed on Forms 78, 79 and 9325, after an acceptance acknowledgement is processed On Form 9325, the DCN also is displayed if the transmission is for a 4868 In a business return, the SID is displayed on the EF_ACK page

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Form 9325 After Irs Acceptance Notifying The Taxpayer

Title form 9325 (rev ) subject acknowledgement and general information for taxpayers who file returns electronically created date 4/14/1999 pm

January 14 Taxable Talk

Fill Free Fillable Irs Pdf Forms

Irs Forms Publications Lattaharris Llp

6742 Irs Forms And Templates Free To Download In Pdf

17 21 Form Irs 9325 Fill Online Printable Fillable Blank Pdffiller

E Filing Your Tax Returns Advisory Associates

12 Form Irs 9325 Fill Online Printable Fillable Blank Pdffiller

Irs Forms Publications Trout Cpa

Www Irs Gov Pub Irs Prior P1345 09 Pdf

Www Calt Iastate Edu System Files Premium Video Files Getting ready for the 17 filing season Pdf

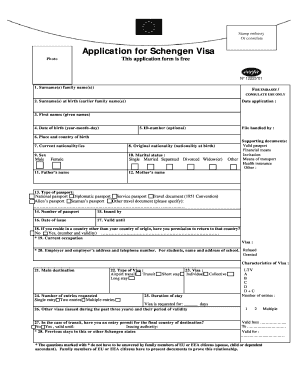

Form I 864 Affidavit Of Support Help Center Chodorow Law Offices

Latino Tax Pro Live With Michael Jenkins From Drake Software Facebook

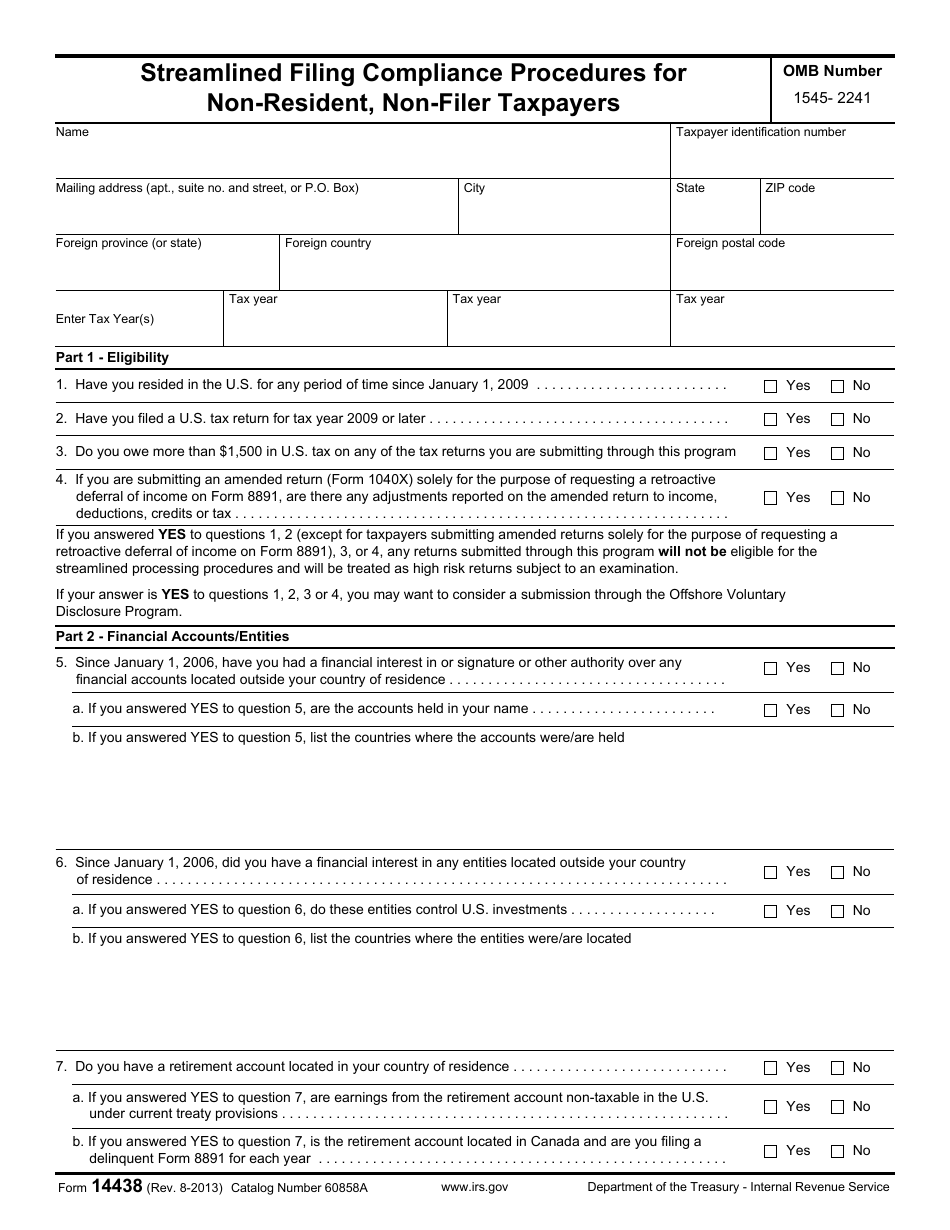

Irs Form Download Fillable Pdf Or Fill Online Streamlined Filing Compliance Procedures For Non Resident Non Filer Taxpayers Templateroller

Www Reginfo Gov Public Do Downloaddocument Objectid

Client Communications E File And Paper File Options Drake19

Fillable Online Form 9325 Rev 3 08 Acknowledgement And General Information For Taxpayers Who File Returns Electronically Fax Email Print Pdffiller

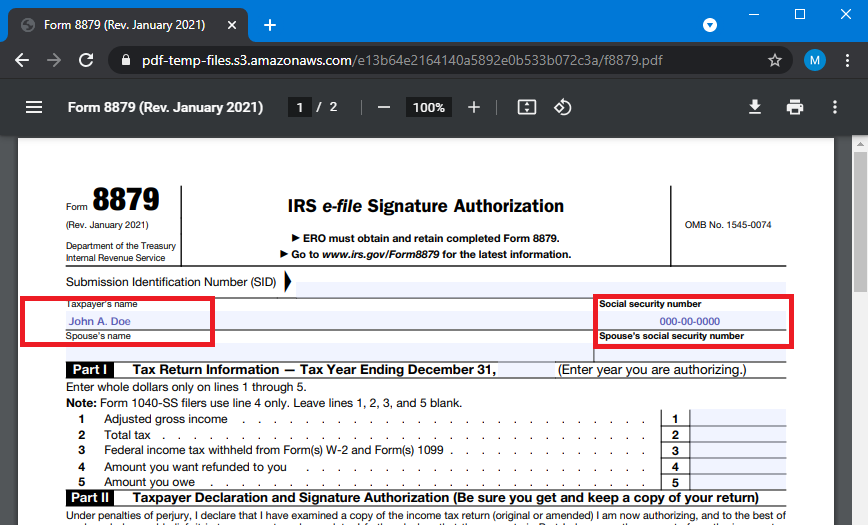

I R S F O R M 8 8 7 9 P R I N T A B L E Zonealarm Results

Form 9325 Fill Online Printable Fillable Blank Pdffiller

Form I 864 Affidavit Of Support Help Center Chodorow Law Offices

Proseries Extensions And How To Report Them Tax Pro Center Intuit

How To Complete Irs Form 79 Pdf Co

Form 79 Rev January 21 Pdf Dochub

Form 9325 After Irs Acceptance Notifying The Taxpayer

Filing Returns Electronically

Drake Us Wp Content Uploads 18 12 A Day In The Life 18 Pdf

Fillable Online Irs Form 9325 Rev 1 16 Acknowledgement And General Information For Taxpayers Who File Returns Electronically Irs Fax Email Print Pdffiller

Form 9325 Fill Online Printable Fillable Blank Pdffiller

Form I 864 Affidavit Of Support Help Center Chodorow Law Offices

Business Returns Ef Notice Page Similar To Form 9325

Form 9325 Fill Out And Sign Printable Pdf Template Signnow

F9325 1 Pdf Form 9325 January 17 Department Of The Treasury Internal Revenue Service Acknowledgement And General Information For Taxpayers Who File Course Hero

Filing Returns Electronically

6742 Irs Forms And Templates Free To Download In Pdf

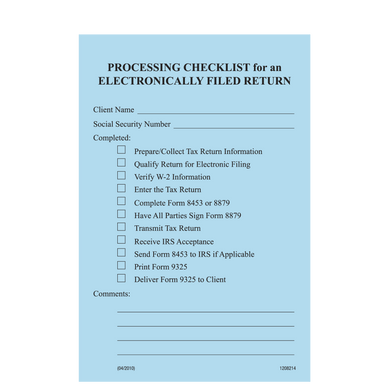

E Filing Checklist Post It Notes 5 Pads

How To Complete Irs Form 79 Pdf Co

I R S F O R M 8 8 7 9 P R I N T A B L E Zonealarm Results

Fillable Online Internal Revenue Service Form 9325 Acknowledgement And Fax Email Print Pdffiller

Fill Free Fillable Irs Pdf Forms

Business Returns Ef Notice Page Similar To Form 9325

Irs Forms High Res Stock Images Shutterstock

Fillable Form 9325 Acknowledgement And General Information For Taxpayers Who File Returns Electronically Printable Pdf Download

12 Form Irs 9325 Fill Online Printable Fillable Blank Pdffiller

Shop Paper Products Folders Tax Supplies Tax Supplies Page 1 Greatland Com

Form 79 Edit Fill Sign Online Handypdf

Form 9325 Acknowledgement And General Information For Taxpayers Who File Returns Electronically 14 Free Download

Coronavirus Stimulus Check How To Get One If You Don T File Your Taxes Cashay

Fillable Form 9325 Acknowledgement And General Information For Taxpayers Who File Returns Electronically Printable Pdf Download

2

Submission Id Sid

Filing Returns Electronically

Drake Us Wp Content Uploads 18 12 A Day In The Life 18 Pdf

Cs Thomsonreuters Com Support Reference Pdf Ub21 Pdf

Ecfsapi Fcc Gov File Pdf

When A Tax Return Is Electronically Filed Taxpayers Should Receive Certain Course Hero

Form 79 Irs E File Signature Authorization 14 Free Download

Irs Form 9325 Fill And Sign Printable Template Online Us Legal Forms

14 Form Irs 9325 Fill Online Printable Fillable Blank Pdffiller

Www Calt Iastate Edu System Files Premium Video Files Getting ready for the 17 filing season Pdf

Form 9325 Acknowledgement And General Information For Taxpayers Who File Returns Electronically

6742 Irs Forms And Templates Free To Download In Pdf

Fillable Form 9325 Acknowledgement And General Information For Taxpayers Who File Returns Electronically Printable Pdf Download

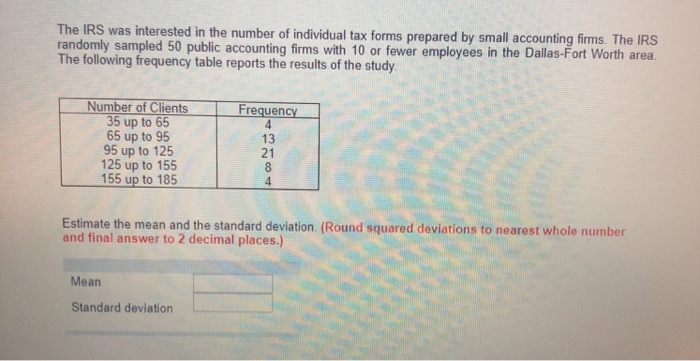

The Irs Was Interested In The Number Of Individual Chegg Com

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

How To Complete Irs Form 79 Pdf Co

Fill Free Fillable Form 9325 Acknowledgement And General Information For Taxpayers Pdf Form

Tax Returns Merged National Visa Center Dept Of State Visajourney

Www Irs Gov Pub Irs Prior F78 17 Pdf

Electronic Return Post It Notes 4x6 Item 16 610

Fill Free Fillable Irs Pdf Forms

Form 9325 Fill Online Printable Fillable Blank Pdffiller

コメント

コメントを投稿